Q2 CIO Survey Results: A Battle on All Fronts

We had the opportunity to survey 70+ CIOs around their challenges and budgets for the year. Upon reviewing the data, my first takeaway was: This is a battle on all fronts, though AI is still top of mind both for CIOs and for their boards. This post will analyze data behind respondents’ top three indicated challenges (digital transformation including AI (38%), talent acquisition and development (15%), and selling initiatives internally (15%)).

As their top challenge over the next 12 months, “Digital Transformation (including AI)” led the way with 38%. Our next question asked, “Where are you most uncertain/feel the least prepared for over the next 12 months?” and the answer was the same: “Digital Transformation (including AI)” at 36%.

Boards and/or CEOs are exerting pressure to adopt AI. This question is worth repeating in its entirety with the results:

To what extent has your organization’s Board and/or CEO exerted pressure for AI adoption since the start of 2024?

- 6% No Pressure: The Board has not expressed any urgency or expectations regarding AI adoption.

- 24% Minimal Pressure: There have been occasional discussions, but no significant push for immediate AI implementation.

- 48% Moderate Pressure: The Board has shown interest and expects progress in AI initiatives.

- 18% High Pressure: The Board actively encourages AI adoption and expects tangible results.

- 3% Intense Pressure: The Board considers AI adoption critical for the organization’s success and demands swift action.

Interestingly, this very closely matches a Normal Distribution (bell curve), with fewer organizations at either extreme end (no pressure or intense pressure) and most clustered in the middle (somewhere between minimal pressure and high pressure, with a plurality of organizations seeing moderate pressure).

Contrast this to self-reported AI technology adoption since the start of 2024, and it appears there is still a push/pull between the board/CEO position and on the ground implementation. When asked, “How rapidly has your organization embraced AI technologies since the start of 2024?”, 42% selected “Cautious Pace: We have taken measured steps, carefully evaluating AI solutions before implementation” and another 42% selected “Steady Progress: Our adoption has been consistent, with gradual integration of AI into existing processes.” Only 9% selected a more aggressive pace, and 6% selected N/A.

Talent acquisition and development was another key theme and struggle, impacted by more prevalent work from home (WFH) environments than pre-pandemic and culture fragmentation during remote work periods. 15% of CIOs listed this as their top challenge over the next 12 months, and 9% felt the least prepared for it. Zooming in on these issues, 27% are having challenges reskilling/upskilling their workforce, 20% are struggling with remote-first culture & tooling, 13% with talent acquisition, and 13% with geographically distributed teams.

Of those who support remote work, the biggest challenges they faced were a lack of connection within teams (38%) and inability to enjoy company culture (20%). Lack of intensity (16%), dissatisfied or isolated employees (14%), and lack of accountability/performance (8%) also posed significant challenges.

Some organizations are seeing benefits from remote work, however. 38% saw increased talent availability due to national hiring, and 34% saw increased employee retention. These benefits may be supported by or realized through mitigation strategies: 27% cited improved collaboration tools, another 27% cited mandatory “in office” days, and 16% cited employee clustering as strategies that have helped mitigate remote work challenges.

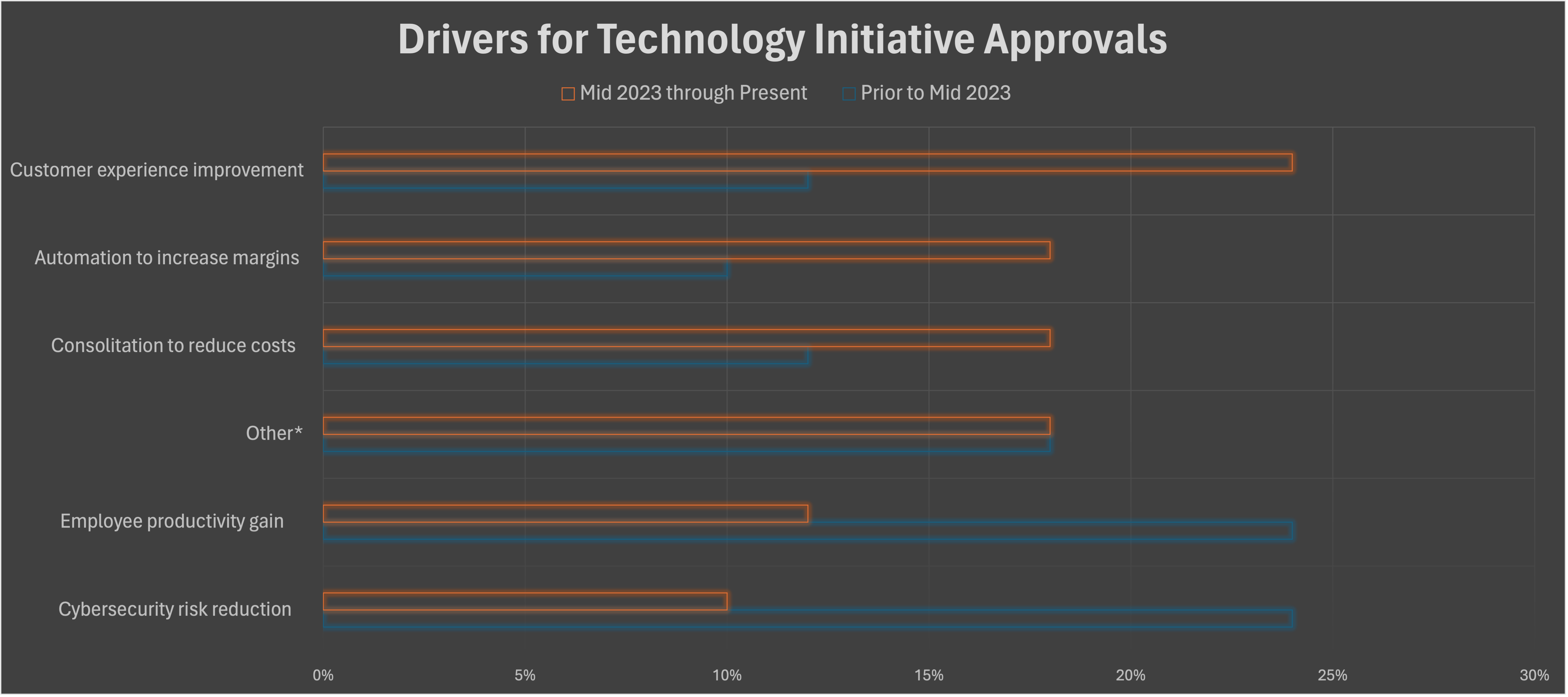

Finally, 15% of CIOs cited “selling initiatives internally” as their top challenge for the coming year, but no respondents listed this as an area that they feel uncertain/less prepared. Selling initiatives internally is not a new challenge and appears to be a skill that CIOs feel more confident in exercising. However, the drivers that have helped get technology initiatives approved over the last 12 months have shifted from the previous 12 months, and there is no single majority driver.

*: Other includes regulatory pressures, reducing technical debt and risk, financials, and break/fix.

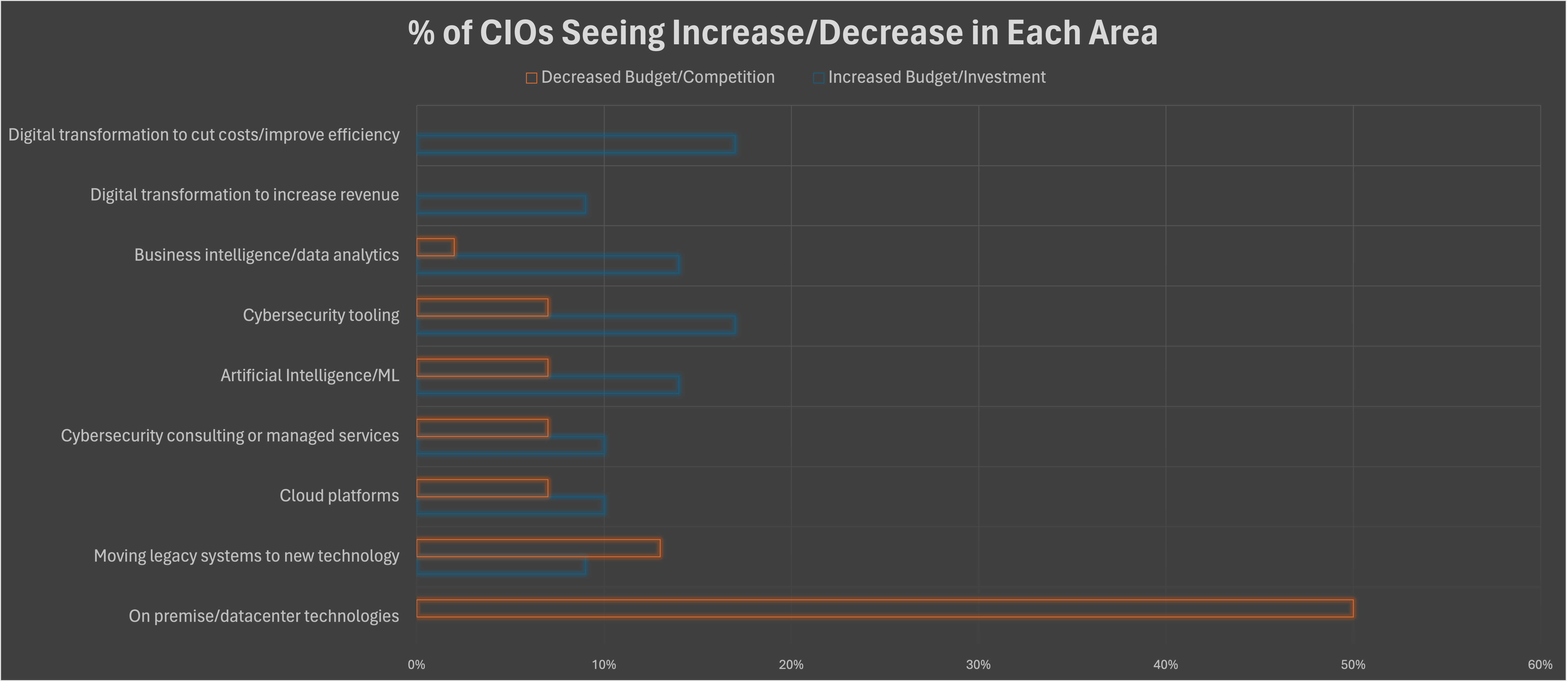

Where CIOs are seeing increased budgets or appetite for investment was also fairly evenly split across the options presented. Note that the percentages represent the percentage of respondents seeing a change, not the magnitude of the change.

Budget changes line up fairly well with technology trends and what an outside observer might expect from a modern enterprise. One area to highlight is that a full 50% of CIOs are seeing decreased budgets for on-premise/data center technology spend, and other than that category, that at least 9% of CIOs are seeing increased budget in every area presented:

- 17% Cybersecurity tooling

- 17% Digital transformation to cut costs/improve efficiency

- 14% Business intelligence/data analytics

- 14% Artificial Intelligence/ML

- 10% Cloud platforms

- 10% Cybersecurity consulting or managed services

- 9% Digital transformation to increase revenue

- 9% Moving legacy systems to new technology

Modern CIOs continue to balance multiple shifting initiatives, driven by recent disruptors (AI, Pandemic/WFH, cyber attacks, and - less recently - public cloud). Underlying CIOs’ technical and people priorities is more broad economic uncertainty (28% said this is what they are most uncertain/least prepared for).

Legal Vertical Breakout Analysis

For our ivision CIO Forum legal vertical, their top challenge was the same as the broader group (Digital transformation including AI) at 37% for the legal vertical vs 38% for the broader group, and selling initiatives internally (13% vs 15%) and talent acquisition and development (13% vs 15%) were top of mind as well. However, security & data privacy (including compliance) was 24% of Legal CIOs’ top challenge over the next 12 months, compared with 8% of the broader group.

These challenges also mapped to areas of uncertainty similar to the broader group. Notably, in the Legal CIO vertical, 0% selected “Economic Uncertainty” as the area they feel most uncertain/least prepared for over the next 12 months, versus 28% in the broader group.

The Legal group also had a higher emphasis on employee productivity gain (38% vs 12%) and cybersecurity risk reduction (38% vs 10%) as a driver for getting initiatives approved internally within the last 12 months. Earlier than 12 months ago (mid-2023 and earlier), employee productivity gain was not listed by any Legal CIO as a driver for approvals. However, earlier drivers for the broader group mapped more closely to present day drivers for the legal vertical. Prior to mid-2023, 24% of the broader CIO group saw each of cybersecurity risk reduction and employee productivity gain as drivers for initiative approvals, which maps more closely to (though still trails) the legal vertical at 38% each in the last 12 months. Those drivers have since declined in the broader group to 10% and 12%, respectively.

On where CIOs were seeing decreased budgets, a full 89% of Legal CIOs indicated they saw decreased budgets for on-premise/data center technologies vs 50% for the broader group.

In most other responses, such as challenges with employees and WFH and AI adoption pressures, the Legal CIO group was similar to the broader group surveyed.

Any insights from the data that we missed? Something you want us to ask about next quarter? Need help in any of these areas? Drop us a line!